How can foreign investors set up a company in India?

When opening a company in India, local and foreign investors can register several types of business forms. Regardless of the legal entity that was selected for incorporation, the registration procedure follows the same steps prescribed under the legislation for commercial companies. Opening a business in India is not complicated, as long as the Company Law is respected.

As a general rule, the majority of the Indian companies are registered as private limited companies, this being the most common way to start a business here. Our team of specialists in company formation in India can offer in-depth assistance on the registration of a legal entity and can offer advice on the regulations applicable in this sense.

| Quick Facts | |

|---|---|

| Types of companies |

Sole proprietorship One-person company Private limited liability company Public company |

|

Minimum share capital for LTD Company |

1,160 USD paid on incorporation |

|

Minimum number of shareholders for Limited Company |

2 |

| Time frame for the incorporation | 8 weeks |

| Corporate tax rate | 22% standard rate + CESS and surcharge – total tax rate is 25.17% |

| Dividend tax rate |

20% |

| VAT Rate |

The standard rate is 28%. Reduced rates of 18%, 12%, and 5% also apply. |

| Number of double taxation treaties (approx. ) | 88 |

| Do you supply a Registered Address/Virtual Office? | Yes |

| Local Director Required | YES, at least one resident director. |

| Annual Meeting Required | Yes |

| Electronic Signature | Yes |

| Is Accounting/Annual Return Required? | Yes |

| Foreign-Ownership Allowed | Yes |

| Any tax exemptions available? | No |

| Any tax incentives (if applicable) | Reduced rate of 15% for manufacturing companies, minimum alternative tax avaiable for certain companies. |

What are the steps for registering an Indian company?

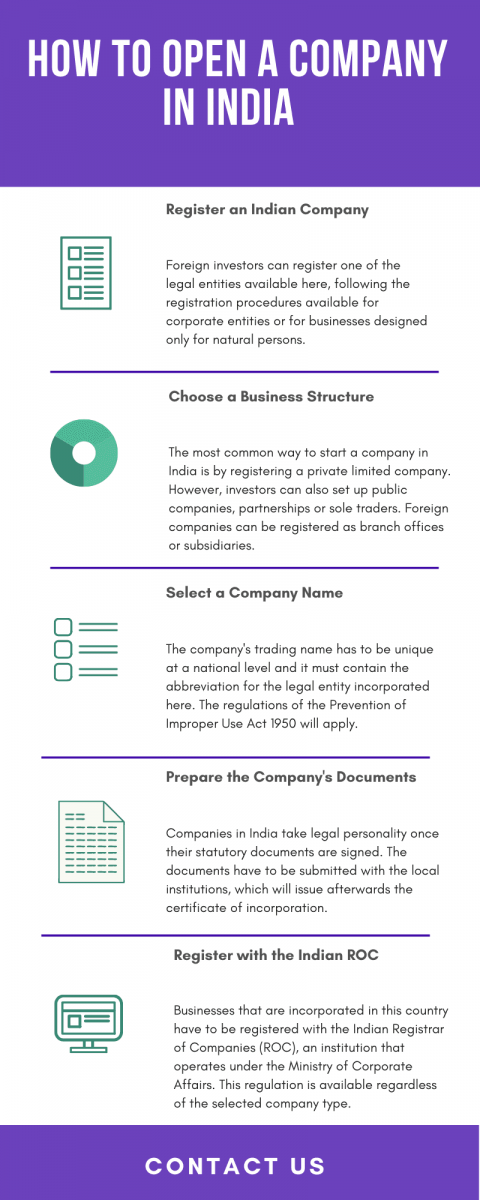

All companies operating in India are required to register with the Registrar of Companies (RoC), a department working under the supervision of the Ministry of Corporate Affairs. In order to open a company in India, the investors will need to follow specific incorporation steps, once they have chosen abusiness form suitable for their investment plans in this country, such as:

- select a trading name for the company, which has to beunique at the level of theentire Indian territory;

- prepare the application for registration of thebusiness name, which should includeaminimum of four proposed trading names and a maximum of six;

- once thecompany’s statutory documents are prepared, they need to be filed with the RoC;

- register for social security, once the company concluded the first employment contract.

If you want to open a company in India, our agents can take you through all the steps. If you would like to set up a business in Hong Kong, we can put you in contact with our partners.

The following video offers a short presentation on the registration of an Indian company:

It is necessary to obtain a Director Identification Number (DIN), regardless of the nationality of the futuredirector. Theproposed directors will also need a Digital Signature Certificate (DSG), which represents the director’s signature necessary for variouscompany documents that are registered and filed with the Registrar of Companies. More specifically, all thedirectors will need a Class II Digital Signature Certificate, which can be provided by one of the licensed vendors of the Ministry of Corporate Affairs.

Further on, the Registrar of Companies will approve thecompany’s trading name, after the company’s representatives have sent a proposal in this sense. The institution will approve the trading name if specific conditions are met, which can be detailed by our team of agents in company registration in India.

What are the steps in selecting a company name in India?

When selecting a trading name for a company in India, investors have to make sure that their company name does not resemble with the ones of other companies that are already operating on the local market. The company name must also respect the requirements imposed under the Prevention of Improper Use Act 1950.

When selecting a company name, the investors will need to complete an online document, the eForm1, which must be submitted with RoC. It is necessary to know that the procedure will require the payment of a small fee and in the case in which the trading name wanted by the investors is not available, they can propose other trading names under the same application.

We can also assist business owners who want to register trading names as trademarks in India.

What should investors take into consideration in order to open a company in India?

Those who want to register a company in India will also have to file the company’s statutory documents (articles of association and memorandum of association) and the documents must contain the signature of a company secretary. The registration procedure will incur the payment of specific fees, including thestamp duty. If the steps presented above are successfully completed, the investors will receive the certificate of incorporation and other important steps can start, such as theregistration for tax matters.

Why start a private limited company in India?

One of the most suitable ways to start a business in India is by registering a private limited company, as thisbusiness form provides a set of advantages. Thisbusiness form benefits from a great flexibility. In this sense, it is important to know that, when choosing this legal entity, the investors will be able to modify the structure of the company’s ownership. This procedure can be concluded through thetransfer of shares, a procedure that will need the consent of the other shareholders. Some of the basic characteristics of this company type are presented below:

- the private limited company in India is governed by the regulations of the Companies Act 2013 and the Company Incorporation Rules 2014;

- the company can be founded by at least two investors, known as shareholders;

- this company type needs to be represented by at least two directors and maximum 15;

- there are specific residency requirements with regards to the company’s directors, in the sense that at least one has to be an Indian citizen;

- the company’s founders can be represented by natural persons or legal entities, domiciled in India or abroad.

Investors must also know that this business form canown property in its own name, which can refer to a wide category of assets, such asintangible or tangible assets – machinery, land, factories and others. When starting this type of company, the investors will also need to set up an official business address, under the requirements of the local legislation. This is applicable to all types of Indian business forms, some of which are presented below.

If you plan to open a company in India, our agents can help you.

What is a sole trader in India?

The Indian sole trader represents the simplest way for starting a company in India; this entity is also known as an individual entrepreneur. It defines a type of company that is registered by a single businessman, who carries all the business operations in his/her own name.

The person opening the sole trader is responsible for any matter related to his/her company and it is also important to know that if the company will have various financial difficulties, such as debts or bankruptcy, theowner will be liable withhis/her personal assets, as there is no legal distinction between the two entities. However, one of theadvantages of the sole trader is given by the simple registration procedure and basic compliance with the local authorities. Most of the Indian sole traders are operating in theagriculture and retail sectors.

Those interested in starting a company in India as a sole trader have to complete fewer registration steps compared to any of the other legal entities operating here. Some of the basic aspects that have to be decided refer to the selection of a suitable company name and finding a location that can be used as the company’s official address.

There are several ways through which a sole trader can be registered in India. For example, if the sole trader is registered with the purpose of running a store in this country, the entity can be registered under the regulations of the Shop and Establishment Act.

In this particular case, a shop will refer to a specific location where goods are sold or where various services are provided to customers. It also defines an office that is used in connection with the trade in which the person is involved, which has the main purpose of selling various goods or services to clients.

Can a sole trader be changed into another legal entity in India?

Please note that the Indian legislation provides the legal framework for the conversion of a sole trader into a limited liability company. This is recommended if the business carried out as a sole trader develops, as the owner will be personally liable for a growing business, which can lead to high debts.

In order to protect the business, it is recommended to transform the sole trader into a limited liability company, by following the standard conversion method applicable in India; the process is formed by several steps and it needs a set of documents and this is why we highly advise addressing to our team of consultants in company registration in India. Some of the basic procedures that have to be completed in this case are presented below:

- as the company will be converted into a corporate body, the investor will need to obtain a Digital Signature Certificate and a Director Identification Number;

- this is necessary as the limited liability company will need to have a director;

- the investor will need to apply with the MCA for the registration of the new company type;

- modifying the information of the bank account, by including the new company data;

- submitting any required documents, such as identity documents, proof or registered office, and others.

Opening a business in India as a foreigner implies completing various formalities, including related to taxation. An accountant in India is familiar with accounting’s foundational concepts. It’s crucial to classify spending properly as either capital (like fixed assets) or revenue (like purchases) expenditures. Financial losses can result from inaccurate accounting. Although there have been many accounting technologies developed over the years, human intellect cannot be replaced.

With the support of technology, a strong centralized processing system, and a staff of impeccable professionals and helpful customer care representatives, we offer solutions associated with payroll in India. We provide a wide range of services to local and foreign companies with employees in India, in accordance with the provisions of the Employment Code.

The Indian one person company

Another business form available for incorporation in India is the one person company, which represents a hybrid legal entity, comprising the characteristics of a sole trader with the ones of a limited liability company. In other words, this business form is seen as asole trader with more rights and obligations: for example, the founder has toappoint a director, as it is the case of other legal entities with a corporate identity.

When forming a company in India under this legal entity, it is necessary to know that the Companies Act 2013 clearly stipulates that the one person company is seen as a different legal person than the founder, who will assume only limited liability for any debts.

Although this is similar to a limited liability company, it is recommended for registration only in the case of small businesses and it is also important to mention that itcan’t be changed into a company, as prescribed by the Section 8 of the Companies Act.

Why register a public limited company in India?

The Indian legislation allows the registration of a public limited company, which has similar characteristics with thelimited liability company, with the difference that the shares issued by the company can be offered to the general public (this is not the case for a limited liability company).

At the same time, this business form can accept foreign direct investments and it must be set up byat least seven members. More importantly, the shares of the company can be easily transferred and the members are liable only to the extent of their capital participation in the company.

Registrar of Companies in India

The legal procedure for opening a company in India is handled by the Registrar of Companies (RoC), which works under the jurisdiction of the Ministry of Corporate Affairs.

In the situation in which the investors prefer to register a private limited company, the regulations for this business form stipulate that the company should have minimum two shareholders and two directors, with the mention that a natural person can have both the quality of a shareholder and a director. The legal entity can also be represented by another company, but in this case, the entity may act only as a shareholder. At the same time, this company type must also take the necessary measures for VAT registration in India.

The sole proprietorship, which is the simplest form of performing business activities, maybe set up by a natural person. However, it is important to know that investors can also set up a one-person company, which is basically a sole proprietorship that provides limited liability to the company’s founder.

How many companies are operating in India?

The Indian business environment is represented by both local and foreign companies. The data on the businesses registered here is collected by the Ministry of Corporate Affairs (MCA), which gathers information on all the types of companies incorporated in this country. The latest information on the Indian companies is presented below:

- at the level of March 2019, the country had only 317 unlimited companies;

- with regards to the businesses incorporated as companies limited by guarantee, India accounted for 6,890 such companies;

- the preferred company type in India is represented by the company limited by shares, which, in March 2019, accounted for 1,149,167 such businesses;

- overall, at the level of March 2019, the Indian business environment was represented by a total of 1,156,374 companies;

- at the level of January 2018, there were a total of 1,151,153 active companies operating in India.

Our experts can offer more information on how to open a company in India. Please contact our team of consultants in company registration in India for further advice on how to register a business form suitable to the investors’ business plans. Our representatives can provide more information on the advantages and the obligations of each company type in India.